The latest insights from IDC Worldwide Quarterly Mobile Phone Tracker reveal that the EMEA smartphone market is expected to contract by close to a quarter in value terms in the three months to the end of June, after a relatively strong first three months to the year.

The latest insights from IDC Worldwide Quarterly Mobile Phone Tracker reveal that the EMEA smartphone market is expected to contract by close to a quarter in value terms in the three months to the end of June, after a relatively strong first three months to the year.

Measured in retail prices before sales tax and VAT, the second-quarter smartphone total will dip below $19 billion and 63 million units — the smallest quarterly total across EMEA in five years.

“This will be the biggest fall in a single quarter the market has seen since IDC started tracking the region 14 years ago,” said Simon Baker, Program Director at IDC EMEA. “The deepest drop up to now was the 13.0% year-on-year drop in value in the third quarter of 2009 during the financial crisis.”

The 2Q downturn will be most pronounced in Europe, said Marta Pinto, research manager at IDC EMEA. Southern Europe will be badly hit, especially Spain, with a drop in value near a third. But everywhere will be in negative territory compared with the same quarter the year before.

The biggest fall in Europe is expected to be in Russia, where the coronavirus lockdown has been compounded by a drop in the currency. There was some evidence of consumers snapping up phones in the weeks leading up to the lockdown before prices rose, and prior experience of such crises in Russia suggests that the market will contract markedly for some months thereafter.

IDC expects the drop in sales to continue through the third quarter, but the Western European market should see some recovery at the end of the year with Apple’s launch of its anticipated first 5G iPhones. As a spot of light in a dismal picture, Apple has been doing well in Europe, said Pinto.

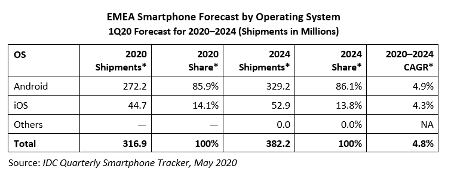

Android will continue to be the dominant operating system for smartphones, driven by lower price points and fierce competition between players in the region. Google’s Android OS will also increase its share in the enterprise segment, driven by the Android Enterprise Recommended Program.

IDC’s Worldwide Quarterly Mobile Phone Tracker fills the demand for detailed and timely information on the total mobile phone and smartphone markets for handset vendors, software developers, service providers, component suppliers, and investors. It provides insightful analysis through quarterly market share data by region. It delivers a quarterly web database that details the performance of the market’s individual players and answers important product-planning and product-positioning questions.

Discussion about this post