The key factors that will drive Mobile Financial services’ growth

In this insightful analysis, Pavan Ramkishan Bachwal, Acting Chief Commercial Officer (Financial Services) at Ericsson, explores the pivotal factors poised to propel the growth of Mobile Financial Services.

The current situation for telcos is a tricky one – they face a market where traditional revenues are declining, and the market is uncertain. As such, any market that can generate additional revenue streams for operators is vital. Therefore, the mobile financial services (MFS) market is one of central importance, which can drive new growth for operators.

However, mobile money is a complex market, with many different trends, and it can be difficult to unpack the key factors to watch and for operators to prioritise for growth. To assist in this task, Ericsson and Juniper Research have created a new study What Will Drive Mobile Financial Services Growth, which has surveyed decision-makers responsible for MFS at Mobile Network Operators (MNOs) across 4 key regions. The survey included 46 respondents from 46 MNOs in 35 countries, all from MNOs that offer MFS presently.

The top ten findings from the study are listed below:

- 40% of Mobile Network Operator User Bases Will Be Actively Using Mobile Financial Services in the Next Five Years

- 80% Growth in Mobile Financial Services Transaction Value Anticipated Over the Next Five Years

- Customer Incentives, Extensive Last-mile Networks and COVID-19 Digital Payments Surge Lead Top Ten Factors That Have Accelerated Mobile Financial Services Success

- Advanced Services to Drive Mobile Financial Services Growth Over the Next 5 Years

- QR Code, AI/ML and NFC Lead List of Technologies That Will Have Most Impact on Mobile Financial Services Over the Next Five Years

- Mobile Network Operators Are Focused on Extending Payments and International Remittances via Partnerships with Merchants and Money Transfer Operators

- Regulations and Taxation, Enduring Preferences for Cash and Security Concerns Are Key Challenges Inhibiting MFS Growth

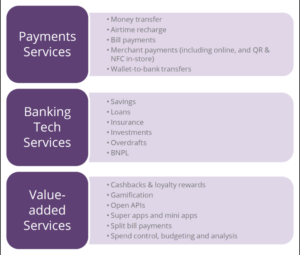

- Service Portfolios Are Evolving Rapidly, with Banking Tech and Value-added Services Taking the Lead

- Mobile Financial Services Critical for Enabling Revenue Growth and Diversification for Mobile Network Operators

- Enabling SDGs, Access to Formal Financial Services and Financial Inclusion Are the Biggest Social Benefits of Mobile Financial Services

For now, we will examine two key findings – finding four and finding eight.

Advanced services to drive mobile financial services growth over the next 5 years

Ultimately to maximise their future chances, MNOs must understand what factors will drive MFS growth, and where to focus their limited resources. Operators stand at a crossroads in many markets, with competition from fintechs and banks, as well as social media financial services becoming paramount.

MFS providers must increasingly focus on advanced services like sophisticated micro-finance services, loans, overdrafts, BNPL, investments, merchant payments, bulk payments etc. By doing this, MFS providers can begin to transition their large user bases to these more advanced services; driving additional revenue streams, offsetting the potential loss of business to new competitors, and reducing user churn.

The priorities for vendors are clear – enhanced user experience, greater personalisation, offering a comprehensive service portfolio, convenience and ease of use, security & trust and driving growth. As such, these priorities will reshape the way MFS providers operate; shaking up their revenue models, product portfolios and user experiences. MFS providers must prepare for this disruption now, or they will be left behind by new fintech and technology company competitors.

Service portfolios are evolving rapidly, with banking tech and value-added services taking the lead

The MFS market is highly varied, with MNOs taking different approaches based on which markets they individually operate within. When looking at which services MFS providers offer, there are a multitude of different ways in which services are provided. As such, we asked our respondents which services they presently offer, which they expect to expand in future, and which they do not intend to pursue.

Figure 1: Categorisation of Different Services (Source Juniper Research)

From only examining these two key trends, it is clear that a large amount of change is coming to the MFS market. MNOs understand their priorities, and as such, they need to choose technology platforms and vendors that enable them to reach their next phases of growth. If they get this choice right, they will be well set to capitalise on future market opportunities.

For further details on this study, diving into every one of our key ten findings, please download What Will Drive Mobile Financial Services Growth here.